With the current economic climate, businesses are looking for every possible way to save money and improve their bottom line. One often overlooked avenue for cost savings is the tax benefits of updating your parking lot pavement. Investing in this essential infrastructure can yield significant financial advantages immediately and in the long term.

The first and perhaps most compelling reason to consider updating your parking lot pavement is the potential for tax deductions. Under Section 179 of the IRS tax code, businesses can deduct the full purchase price of qualifying equipment and software purchased or financed during the tax year. This means that expenses related to the paving, repaving, or significant improvement of your parking lot can often be written off, reducing your taxable income for the year in which the expenses occurred.

Moreover, improvements to parking lots can also qualify for bonus depreciation. This allows businesses to depreciate a percentage of the cost of the improvements in the first year. Since the tax laws are designed to encourage businesses to invest in their infrastructure, this bonus depreciation can make a substantial difference in the overall cost of your paving project.

Beyond the immediate tax benefits, there are other financial incentives to consider. For instance, maintaining a well-paved parking lot can help prevent costly lawsuits. A deteriorating parking lot can lead to accidents and injuries, resulting in potential legal claims against your business. By investing in a quality paving job, you are not only enhancing the safety of your premises but also potentially avoiding hefty legal fees and settlements.

Another aspect to consider is the increased property value of a well-maintained parking lot. An updated, attractive parking area can significantly boost the curb appeal of your property, making it more appealing to tenants, customers, and potential buyers. This increased value can be a crucial factor if you plan to sell your property or seek refinancing in the future.

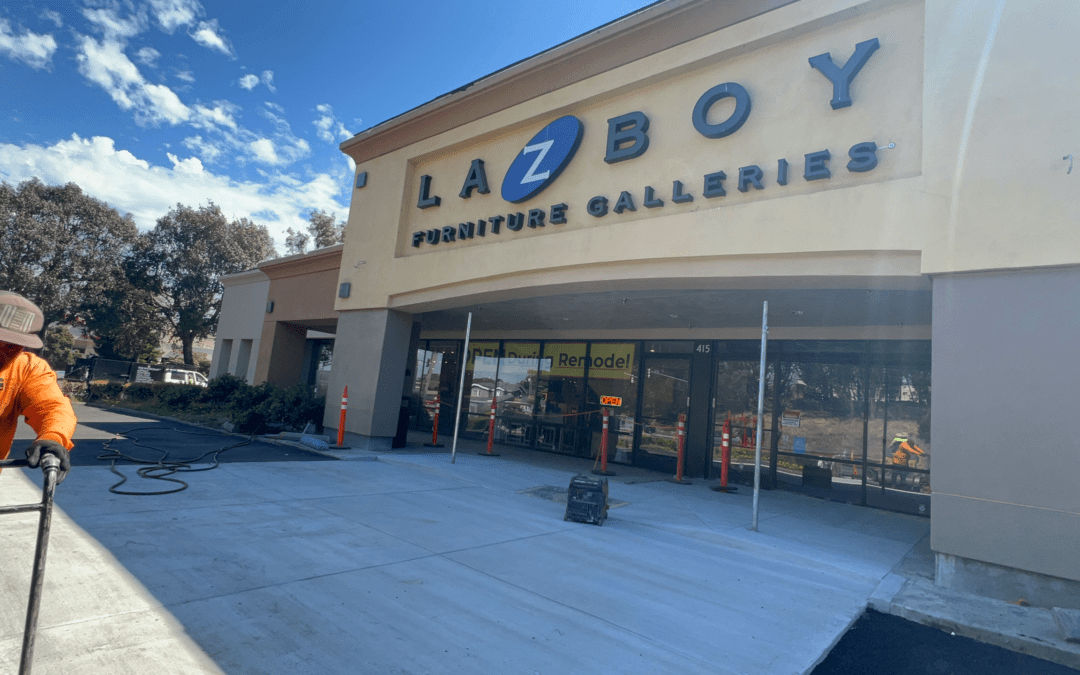

Updating your parking lot pavement also supports your business’s operational efficiency. A smooth, well-marked parking lot can improve traffic flow, reduce congestion, and enhance the overall customer experience. This is particularly important for businesses in the retail and hospitality sectors, where first impressions can make a significant difference in customer satisfaction and repeat business.

In addition to these direct financial benefits, there are environmental and social considerations. Many modern paving materials and techniques are designed to be more environmentally friendly, reducing the heat island effect and improving stormwater management. Businesses can contribute to environmental conservation by choosing sustainable paving options, which can be a valuable selling point to eco-conscious consumers and stakeholders.

It’s also worth noting that updating your parking lot to comply with the Americans with Disabilities Act (ADA) can open up your business to a broader customer base. Ensuring that your parking lot is accessible to all individuals, including those with disabilities, is not just a legal requirement but also a moral imperative. This inclusivity can enhance your business’s reputation and attract a more diverse clientele. On the contrary, leaving your parking lot in shambles opens the door for devious people to take one step in and file a lawsuit.

While the immediate tax benefits are significant, the long-term advantages of updating your parking lot pavement are equally compelling. From enhancing property value and operational efficiency to improving safety and customer satisfaction, the decision to invest in your parking lot pays dividends well into the future. The tax benefits overcome any hesitation in doing the paving work.