Bonus depreciation is a powerful tax incentive that offers businesses the opportunity to accelerate their tax deductions for qualifying assets, such as parking lots. This strategy enables businesses to deduct a portion of the cost of these assets immediately, providing significant tax benefits and potentially boosting cash flow. In this article, we’ll delve deeper into the concept of bonus depreciation, its eligibility criteria, and the implications it holds for businesses.

Understanding Bonus Depreciation

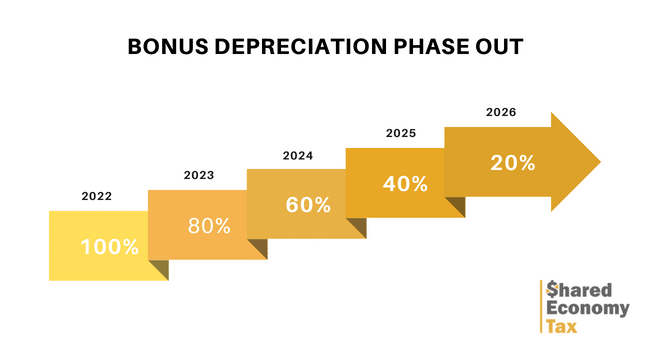

Bonus depreciation was established as part of the Tax Cuts and Jobs Act (TCJA) of 2017, aiming to stimulate economic growth by incentivizing investment in capital assets. Under this provision, businesses are allowed to deduct a percentage of the cost of qualified assets in the year they are placed in service, rather than spreading out the deductions over several years through traditional depreciation methods.

Qualifying Assets and Criteria

Parking lots, a common asset for many businesses, can qualify for bonus depreciation under certain conditions. According to the TCJA, a parking lot may be eligible for bonus depreciation if it meets the following criteria:

Acquisition Date

The parking lot must be acquired and placed in service after September 27, 2017, to qualify for bonus depreciation.

Recovery Period

The parking lot must have a recovery period of 20 years or less. This criterion ensures that longer-lived assets do not qualify for bonus depreciation.

Nonresidential Use

The parking lot must not be used predominantly for residential purposes. This requirement ensures that bonus depreciation is targeted toward business assets.

Technical Requirements

The parking lot must meet specific technical requirements, such as being newly constructed or substantially improved after the acquisition date.

Benefits of Bonus Depreciation

If a parking lot meets these eligibility criteria, businesses can benefit from 100% bonus depreciation in the year it is placed in service. This means that the entire cost of the parking lot can be deducted from taxable income in that year, subject to certain limits.

The advantages of bonus depreciation extend beyond immediate tax savings. By accelerating deductions, businesses can reduce their tax liability, thereby increasing cash flow and potentially freeing up funds for further investment or operational needs. Additionally, bonus depreciation can enhance the attractiveness of capital investments, encouraging businesses to undertake projects that contribute to growth and expansion.

Consultation and Considerations

While bonus depreciation offers compelling tax advantages, navigating its complexities requires careful consideration and expertise. Businesses are advised to consult with tax professionals to ensure compliance with eligibility criteria and to develop optimal tax strategies tailored to their specific circumstances. By leveraging bonus depreciation effectively, businesses can maximize tax savings and enhance their financial position.

Conclusion

In summary, bonus depreciation presents a valuable opportunity for businesses to accelerate tax deductions for qualifying assets, such as parking lots. By meeting eligibility criteria and leveraging this tax incentive, businesses can realize significant tax savings, enhance cash flow, and support long-term growth objectives. However, careful planning and consultation with tax experts are essential to maximize the benefits of bonus depreciation and ensure compliance with regulatory requirements.